how to calculate sales tax in oklahoma

Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. With local taxes the total sales tax rate is between 4500 and 11500.

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

Tax Calculator for Oklahoma for 2021 The states general sales tax rate is 4.

. Multiply the vehicle price after trade-ins and incentives. Oklahoma Sales Tax. The minimum is 725.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Other local-level tax rates in the state of Oklahoma are. Your exact excise tax can only be calculated at a Tag Office.

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. In Oklahoma this will always be 325. Plus Tax Amount 000.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Fast Processing for New Resale Certificate Applications. Standardize Taxability on Sales and Purchase Transactions.

2022 Oklahoma state sales tax. Alone that would be the 14th-lowest rate in the country. The average cumulative sales tax rate in the state of Oklahoma is 771.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. This method is only as exact as the purchase price of the vehicle. The base state sales tax rate in Oklahoma is 45.

The Oklahoma City andor municipality can collect their own rates. However in addition to that rate Oklahoma has. Minus Tax Amount 000.

Find your Oklahoma combined. Just enter the five-digit zip. Exact tax amount may vary for different items.

As a business owner selling taxable goods or services. Before Tax Amount 000. In Oklahoma acquire a sellers permit by following the tax commissions detailed instructions for registration.

This takes into account the rates on the state level county level city level and special level. To know what the current sales tax rate applies in your state ie. Oklahoma has recent rate changes Thu Jul 01 2021.

Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The state sales tax rate in Oklahoma is 4500.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Enter an amount into the calculator above to find out how what kind of. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is.

The state sales tax rate in Oklahoma is 450. Ad Fast Online New Business Calculating Sales Taxes. This is only an estimate.

Register for an account on. Our tax preparers will ensure that your tax returns are complete accurate and on time. How Is Sales Tax Calculated In Oklahoma.

The Oklahoma OK state sales tax rate is currently 45. Oklahoma charges two taxes for the purchase of new motor vehicles. 325 of taxable value which decreases by 35 annually.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. 325 of ½ the actual purchase pricecurrent value.

When calculating the sales tax for this purchase Steve applies the 45 state tax rate for Oklahoma plus 375 for Edmonds city tax rate. We would like to show you a description here but the site wont allow us. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos.

Typically the tax is determined by. Used vehicles are taxed a flat fee of. Depending on local municipalities the total tax rate can be as high as 115.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. How to Register for Oklahoma Sales Tax.

At a total sales tax rate of 825 the. The Oklahoma state sales tax rate is 45. Multiply the vehicle price before trade-in or incentives by the sales tax.

125 sales tax and 325 excise tax for a total 45 tax rate.

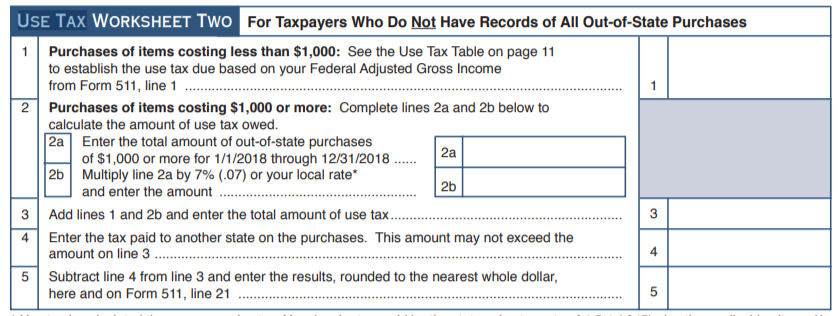

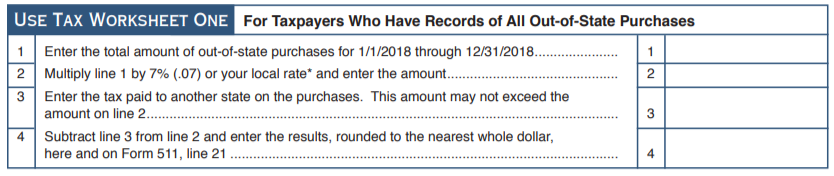

Do I Owe Oklahoma Use Tax Support

How To File And Pay Sales Tax In Oklahoma Taxvalet

Oklahoma Sales Tax Small Business Guide Truic

How To File And Pay Sales Tax In Oklahoma Taxvalet

Christmas Quotes Planner Stickers Winter December Cute Etsy Bullet Journal Christmas Christmas Quotes Planner Stickers

Template Net 13 Contingency Plan Templates Free Sample Example Format 86a4f8a8 Resumesample How To Plan Business Contingency Plan Business Proposal Template

Pin On For The Man In Your Life

How To File And Pay Sales Tax In Oklahoma Taxvalet

Oklahoma State Taxes 2022 Forbes Advisor Forbes Advisor

Business Guide To Sales Tax In Oklahoma

Do I Owe Oklahoma Use Tax Support

Limits On The Budget Oklahoma Policy Institute

How To File And Pay Sales Tax In Oklahoma Taxvalet

The Long And The Short Of It Futility Closet No Game No Life Charles Darwin Married With Children